I can almost guarantee that you don’t know your customer as well as you think you do.

I’ve spent a lot of time talking with marketers and business owners recently.

When I ask them if they know their customer, they typically say “of course we do, I mean we’re selling our products (or services), how could we not know who our customer is?”

“They’re the Director or VP of Marketing, in the retail industry, and 35-45 years old. They have a team of 2-5 people, and have x challenge that we help them with. That’s the person that buys from us.”

…I hate to break it to you, but that’s not knowing your customer.

You’re not conducting user research the way you should be, and it’s hurting your ability to grow and scale your business.

Knowing your customer means:

- Knowing what your customer’s biggest challenge is in regards to your product or service.

- Knowing what questions potential customers will have before they even know they need your product or service.

- Knowing what they’ll research when they have a need for your product or service.

- Knowing what sites they read to educate themselves about the industry you’re in.

- Knowing who they go to for advice about products or services related to what you’re selling? Google? A Friend? And Influencer? A magazine? A book? Television?

- Knowing the objections they’re going to have to your product or service.

- Knowing who your competition is. And not just your direct competition, but your indirect competition.

So many people get obsessed with finding that one “Growth Hack,” “tactic” or “idea” that will help them grow to a $1M or $1B company. But if that’s what you obsess over, you’ll never find the answer to how to grow your company.

What you should obsess over is knowing your customer so well that you can predict their next move.

When you know your customer inside and out, that’s when you’re able to come up with ideas, messaging and tactics that will change the growth trajectory of your business.

Knowing your customer means knowing how to capture your customer’s attention by serving them the right messaging at the right time.

Knowing your customer means knowing what growth channels to test because you know where they’ll be and how to get in front of them.

Knowing your customer means knowing how to build trust and a relationship with them by adding value instead of selling them.

In this post, we’re going to show you how to conduct user research that will tell you what will make your customer purchase from you. I’ll share my experience as well as stories from other businesses, share specific survey questions and their reasoning, and how to modify these techniques for B2C SaaS and B2B enterprise sales businesses.

How User Research Changed The Trajectory of a Business I Worked For

I still remember the first time I was turned onto user research (well, at least the proper way of doing it).

I was a few months into my time in San Francisco, working at ThinkApps, and I decided to go to a GrowthChats event to listen to Hiten Shah give a presentation on Product/Market Fit.

Hiten’s presentation was eye-opening, it went into detail about how he used qualitative feedback to determine if a company had achieved product/market fit, using various tools like Survey Monkey and Qualaroo.

I remember coming back to ThinkApps the day after this presentation with a new mindset. I was determined to see if we had achieved product/market fit and get qualitative data back from our prospects and customers to figure out where we should focus as a company moving forward.

I started meeting with past customers in person and by phone to ask open ended questions. I started surveying past customers through Survey Monkey. I implemented Qualaroo on our site, and lo and behold, I started finding out tons of information that informed all of our decision making going forward.

I started seeing patterns in people’s answers to our questions, I learned about the pains people had with software development, the problems with the industry, who they trusted and didn’t trust, and learned how we could position ourselves in the market to one-up our competition.

ThinkApps is an app development company, and the outcome of this extensive user research included insights about our customers and competitors such as:

- When it came to software development, there was a lack of trust in the industry. Many people had been screwed over by development firms, developers on sites like UpWork, and outsourced developers. Sometimes people had spent $60k-$100k to only be left with an uncompleted project.

- Many development companies didn’t provide visibility into the development process. Developers were known to not give access to source code and sometimes even let clients see the product until it was finished.

- Many people complained about a lack of communication. Sometimes clients would contact their developers for several weeks before getting a response.

- Companies were concerned about their IP and development firms stealing their ideas.

- Project timelines by development companies were typically over promised and under delivered – this sometimes greatly impacted clients as they had pre-planned launches.

Essentially, we had figured out all of the pains and concerns people had about building apps, and then set out on a path to alleviate these concerns.

Here’s a page on the site that speaks directly to concerns people would have.

We then alleviated pains points and concerns in our business model, our content, our messaging, our ad copy, our landing pages, and our sales approach. And within a year, our business grew by 4x revenue.

That’s the power of knowing your customer inside and out.

User Research Is The First, And Most Important Step, A Marketer or Growth Hacker Needs To Employ for Growth

Over the last couple of years, I’ve taken the concept that Hiten shared at his presentation and have modified it to get the information that I need to do my job.

When I enter a new role at a company, researching the customer is always the most important step needed to be effective in my role.

The questions that I use might slightly change depending on the knowledge that I’m trying to gain.

The same process works to determine what messaging will be most effective in ads and on my website, what marketing channels I should test, and what content I should write to attract the right audience.

User Research Questions to Ask Your Customers and Prospects

Conducting a User Feedback Survey Online

The base template that I always use is this sample survey from PMF Survey. I typically take this template and recreate it in Survey Monkey, or you could use a tool like TypeForm to send the survey out to your audience.

Again, the survey questions below would change depending on the information I’m trying to gain.

Let’s go into the purpose behind these questions and how they can be used to extract the information you need:

Question 1: How did you discover (Product or Company Name)?

This question is meant to figure out how a majority of your users found you. The information here can be used to determine what channels have been effective for user acquisition. Also, if you wanted to take this a step further, you could also use data from your CRM to determine which channels have driven the best customers in terms of deal size, time to close, etc.

Question 2: How would you feel if you could no longer use (Product or Company Name)?

This question is meant to determine product/market fit. 40+% of respondents should answer that they would be very disappointed if they could no longer use your product or service.

The open ended box below is to try to get people to explain why they feel that way. If you haven’t achieved product market fit yet, use the feedback from the survey to improve your product or service and retest after implementing changes.

Question 3: What would you likely use as an alternative to (Product or Company Name) if it were no longer available?

This question is meant to determine what your users consider to be your competition. Hint: It’s not always what you’d think.

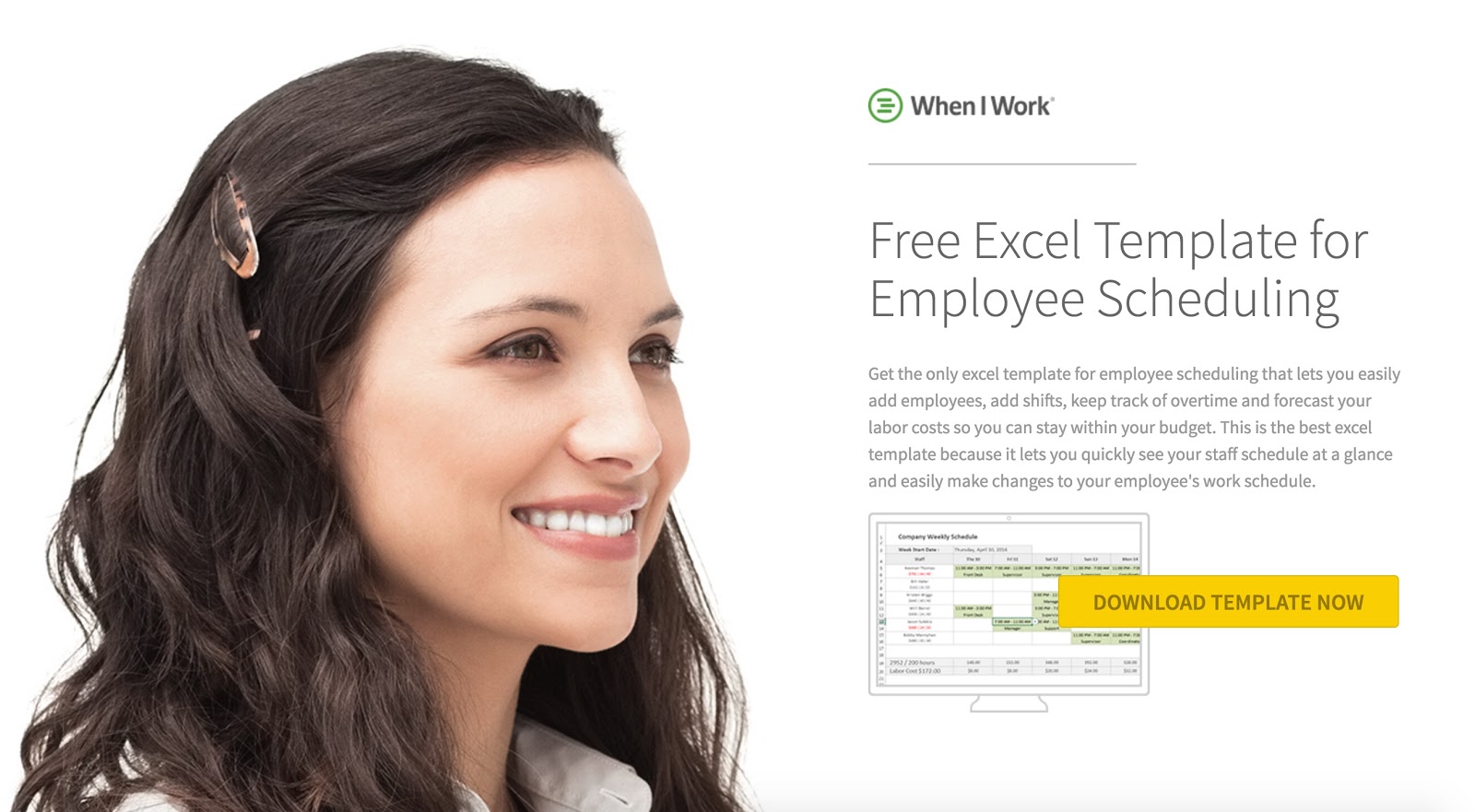

A great example of this comes from when Sujan Patel ran Growth at When I Work – a SaaS company for online employee scheduling. I remember hearing the story from him, that when they conducted user research, they found that instead of customers mentioning a competing SaaS scheduling platform, the largest competition was actually using an Excel spreadsheet to schedule your employees. They used this information to come up with an onboarding program to take people off of Excel and into the When I Work product. That’s the kind of value this type of information can provide.

In fact, “Excel” as the primary competitor became so well known, that they were able to use this to collect leads for their app by offering Excel templates for scheduling in exchange for email addresses.

Question 4: What is the primary benefit that you have received from (Product or Company Name)?

This question determines the main benefit that your customer received from your product or service.

Again, a lot of the times you think your product or service helps your customers in one way, and through this question you uncover that the main value that they got from your product or service is way different than what you thought.

You should look for commonalities amongst respondents’ answers and then test using the learnings in things such as messaging or ad copy.

Question 5: Have You Recommended (Product or Company Name) to anyone?

This question will determine two different things:

- If people are recommending your product or service to others

- How they described it to others***

The second part of the question is important to help narrow in on compelling company messaging. A lot of times companies come up with really lengthy and confusing way to describe what they do – hearing how your customers describe what you do to others can help you learn how other people think of your company.

For example, here is how one company describes their CRM:

It’s hard to imagine that prospects actually say they are desperate to “optimize customer interactions to return maximum value”.

On the other hand, here’s messaging from Base, another CRM platform:

Not only does that make immediate sense to a human, there is something more subtle in their messaging: it’s clear they’ve learned that there are two distinct users they need to satisfy: salespeople, and sales managers. And, importantly, those two groups have different wants.

Question 6: What Type Of Person Do You Think Would Benefit from (Product or Service Name)?

Many times we assume that we know our audience inside and out – that we know the perfect use case for our product or service. A lot of the time, when using this question, you’ll be turned onto an audience that could be a great use case for your product that you were completely unaware of.

Question 7: How Could We Improve (Product or Company Name) To Better Meet Customer Needs?

This is often times the most important question, second to the primary benefit people find from using your product or service.

This will give you a good indicator of where your product or service is falling short, and how you can fix this to help reduce churn, get closer to product/market fit, or improve relationships amongst your customer base.

For marketing (or growth) to be successful in an organization, they typically need to be working with, or tied directly to, the product team. While the product team would typically take ownership of this type of feedback surveying, I think it’s important for this responsibility to lie under marketing. A good marketer should not only be concerned with acquisition, but should be concerned with retention and LTV as well. Knowing where your product or service falls short is important knowledge for a marketer to have.

__

Companies often assume that they know their customers in depth, but surveying in this way helps you gain a different perspective on your customers – hearing how customers think of you in their own words.

The insights gained from running surveys like this are key to making informed decisions about how to improve your product or service, where to focus company resources, how to best catch your potential prospects’ attention, etc.

Here’s a great resource, if you’re looking for more survey questions to ask your customers.

How and Why You Need To Modify This Approach For SaaS Companies

For consumer SaaS companies, I’d recommend using the same survey technique but segmented amongst three audiences:

- Your most active and loyal users

- Your infrequent users

- People who’ve signed up for a trial and/or your service but have never used it

If you run the survey across your entire customer base, and don’t segment by these types of customers, then the data will be skewed and you’ll be unable to make informed decisions.

What’s interesting if you break out responses in this way is that you’ll be able to determine why some of your users are more active than others, why some people only log in or user your service less than others, and why people churn.

By collecting this type of insight, you’ll be able to make company or product changes that should help you scale.

How and Why You Need To Modify This Approach For B2B Companies

For B2B companies, a slight modification on this technique: you could run this survey amongst your highest contract value (or best customers) – the top 20% and then the other 80% of your customers to see the difference amongst respondents answers.

A Note on Statistical Significance and How to Interpret the Qualitative Data

Some people might argue that they don’t have enough customers or that segmenting data in the ways above would lead to data that is of non statistical significant value. Yes, that is correct, but what’s important to note here, is this is just supposed to give you indicators on areas to explore.

By using the process outlined above, it should give you ideas for things to test – feature improvements, product improvements, messaging, marketing channels, etc.

Take all of the responses to questions and start looking for patterns amongst answers. Pull out those ideas, right down things that stick out to you in each question asked and start coming up with ideas for tests to run.

Questions? Comments? Leave them below.

Want us to write an in depth case study or story like this about you or your company? We’ll also drive traffic to it. Apply here.

Like this article? We produce stories like these for our clients, learn more here.

User Research Survey Email Template

Where should we send the template?

You'll also be joining our email newsletter, where we send in depth content marketing articles (like this one) as well as exclusive email-only ideas about once a week. It's free and you can unsubscribe at any time.